FAQ’s: Leasing Overview

Companies often come to us with an urgent need for state-of-the-art remote visual inspection equipment or non-destructive testing technologies. The common first thought is to purchase the device outright. This option, while viable, overlooks the benefits that leasing equipment and different financial models offer.

And we understand why too. Outright purchasing has been a common practice among small and medium businesses for many years. The way we look at capital expenditure, however, is changing – and for the better.

At Nexxis our goal is to custom-fit both a technical and a financial solution to suit your business or project needs. State-of-the-art equipment is only part of the equation. Applying this equipment to your project in both a technical and a financial manner that is cost-effective long term is the other part of the equation.

We have collated the following common questions that continually arise from our clients to help you make decisions for your project or business:

Q #1: Should I purchase or lease when my RVI or NDT needs are urgent?

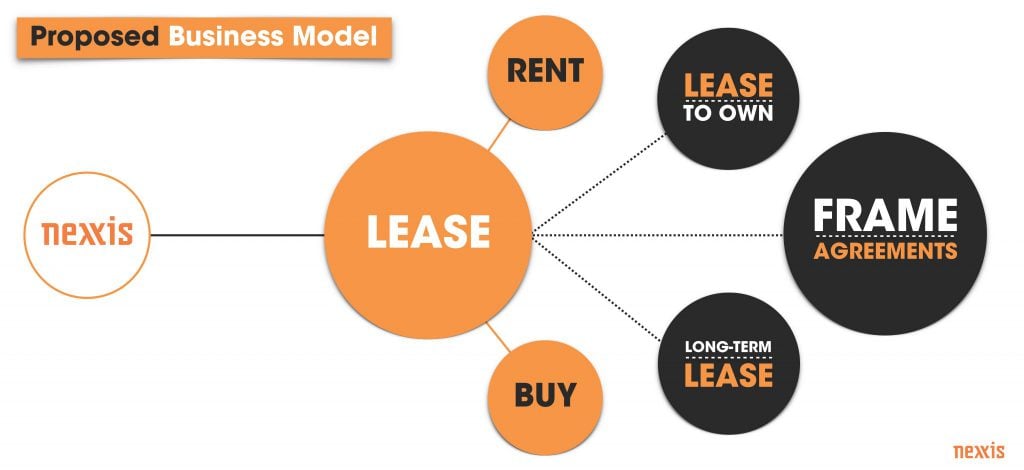

A: You have multiple choices when it comes to deciding the best option for your project or business including rent-to-own, long-term leasing or outright purchase. At Nexxis we like to spend time with you to understand the specifics of your situation and suggest a financial and equipment model that will best suit your needs. Our goal is to leverage our experience with clients across a broad range of project and financial scopes, from small one-off purchases to long-term leases, and suggest a financial model that best suits your particular needs.

Q #2: Our organization has a ‘purchase only’ policy, can I still lease equipment?

A: We frequently hear clients comment that they must purchase equipment instead of lease, as their organization has a ‘purchase-only’ policy. Our recommendation is always to review that policy. Our experience has shown us that these ‘policies’ are often more habits amongst management rather than strict corporate policies. It is always prudent to evaluate several factors before committing to capital expenditure, and long-term leasing has proven benefits for many projects and businesses that far outweigh the benefits of ownership.

Q #3: Are there tax advantages to leasing?

A: Put simply the cost of cash is usually higher than the rate of debt. We agree the prospect of avoiding interest and financing charges by paying cash is attractive. But cash isn’t free. It’s a limited asset, and there may be better ways to use it than tying it up in a depreciating asset like technical RVI and NDT equipment.

In today’s challenging economy, keeping cash on hand makes it easier to seize a business opportunity before your competitor can arrange to finance, or to weather a downturn that cripples your competition. By spending cash on equipment, you can also lose the tax advantages and residual-value benefits that leasing provides – the amount the lessor can expect to recover by selling the asset after the lease ends.

Ultimately, having cash in hand to invest in your business provides far great flexibility to adapt to market conditions and seize opportunities to grow your business which in turn can provide returns that are far greater than the interest rate of a lease.

The diagram above illustrates the different options made available by Nexxis.

Q #4: Is owning more cost-effective than leasing?

A: The best solution depends on your situation. You may do a net present-value comparison between lease and purchase, and conclude that owning is cheaper. But as we described in the previous answer, the cost of cash is often higher than the debt rate.

Cash is a scarce asset on the balance sheet, and a reasonable position is to use the Weighted Average Cost of Capital as the discount factor.

Even if you believe today that the equipment will be kept for a long-time, a lot of things can change. A 36-month fair market value lease preserves substantial future flexibility at little or no additional cost.

Q #5: What finance options are available?

A: The best solution depends on your situation. You may do a net present-value comparison between lease and purchase, and conclude that owning is cheaper. But as we described in the previous answer, the cost of cash is often higher than the debt rate.

Cash is a scarce asset on the balance sheet, and a reasonable position is to use the Weighted Average Cost of Capital as the discount factor.

Even if you believe today that the equipment will be kept for a long-time, a lot of things can change. A 36-month fair market value lease preserves substantial future flexibility at little or no additional cost.

Q #6: How does a long-term lease work?

A: Long-term leasing ensures a regular, low monthly payment that’s easy to budget for. It reduces the total cost of ownership since the lease payment reflects the residual value.

This also eliminates end-of-lease disposal issues and a hardware lease helps you meet changing capacity requirements by allowing you to add or upgrade systems at any time during the lease term. Nexxis also offer flexible Frame Agreements, delivering the very best elements available within the long-term leasing structure.

Q #7: Why lease when we have a good credit line?

A: A line of credit is limited and often has significant additional costs associated with it. Typically a line of credit has to be secured by high-quality assets for every dollar borrowed. This makes it a limited resource that should be kept in reserve for items that cannot be financed any other way. Lines of credit are also usually short-term funded, so there is a substantial risk of interest rates going up over time.

Nexxis offers leasing rates are fixed over the entire leasing period, which makes forecasting and budgeting much easier.

Q #8: How does a lease-to-own agreement work?

A: At Nexxis we create a leasing contract that ensures at the end of the agreed leasing period, you own the piece of equipment outright. This option gives you budget flexibility of not having to outlay large financial sums at the outset, while also avoiding loaning fees or interest rates than a typical institutional lending facility would incur.

Q #9: Can we still buy equipment from Nexxis if we choose?

A: Yes. Nexxis provides the leasing and purchasing options and works with you to identify the most suitable. You can then confirm your preferred contract model and the equipment is delivered to your designated location quickly and effortlessly.

Q #10: How does leasing compare to term loans?

A: Term loans often have terms and conditions that can add additional costs and complexity. If you’re considering a term loan, you should carefully consider all of the terms and conditions that come with it. Usually, additional fees are involved, and you may be asked to make a down payment or to keep compensating balances. These are all additional expenses that a lease will not incur.

When compared to obtaining financing through a bank or other financial organization, remember the added value that Nexxis brings as an industry-leading of RVI and NDT equipment.

Q #11: Does Nexxis manage all equipment maintenance and upgrades?

A: Yes. Our Specialist Operations and Specialist Sales personnel will manage all of your equipment maintenance and upgrade needs. Other than the financial benefits already outlined in our different leasing models, Nexxis ensures your equipment is upgraded when new models come to market or firmware is improved.

Q #12: Can Nexxis tailor an individual leasing option to suit my situation?

A: Yes. We can take an aggressive residual-value position on equipment from Nexxis, and provide you with fair market value on mid-term exchanges. As a total financing solution provider, Nexxis will structure a lease that rolls all equipment and services into a single contract with a single periodic invoice to help simplify budgeting for our customers.

Q #13: What happens at the end of the lease period?

A: At Nexxis the process at the end of a leasing period is straight-forward. You can simply return the equipment to us, and we’ll take care of all aspects of equipment disposal, relieving you of any additional cost or legal liability. Then you’re free to move on to the latest technologies on the market.

Of course, if you decide you are still happy with the equipment, you have the option of extending the lease on a monthly basis for the same low payment or negotiating a new contract. The choice is entirely yours.

Q #14: What happens to the equipment once the lease expires?

A: Equipment disposal is a hidden cost that needs to be considered when choosing between purchasing and leasing. Typically it involves unexpected costs and environmental restrictions. When planning a new acquisition of RVI or NDT equipment, it is often the last thing on your mind. There are costs involved however, that are absorbed by Nexxis when taking advantage of our lease agreements.